Top Guidelines Of Independent Investment Advisor copyright

Wiki Article

8 Simple Techniques For Tax Planning copyright

Table of ContentsGetting My Independent Financial Advisor copyright To WorkThe smart Trick of Lighthouse Wealth Management That Nobody is DiscussingAll about Investment ConsultantGetting The Tax Planning copyright To WorkThe Ultimate Guide To Independent Investment Advisor copyrightGet This Report on Private Wealth Management copyrightExcitement About Private Wealth Management copyrightAll about Independent Financial Advisor copyrightUnknown Facts About Tax Planning copyright

They generate money by asking a payment for each trade, an appartment monthly fee or a share fee based from the buck quantity of assets being maintained. Traders searching for best consultant should ask an amount of concerns, including: an economic advisor that works well with you will likely not become just like an economic advisor just who works together another.Based on whether you’re finding a wide-ranging monetary program or are just wanting expense guidance, this concern shall be vital. Financial advisors have different ways of asking their clients, and this will usually be determined by how often you deal with one. Make sure you ask if the consultant uses a fee-only or commission-based program.

7 Simple Techniques For Ia Wealth Management

While you could need to place in some try to choose the best financial expert, the task is beneficial when the specialist gives you solid guidance helping set you in a far better financial position.

Vanguard ETF offers aren't redeemable right with the issuing account except that in large aggregations worth huge amount of money (http://connect.releasewire.com/company/lighthouse-wealth-management-a-division-of-ia-private-wealth-341178.htm). ETFs tend to be at the mercy of market volatility. When buying or selling an ETF, you certainly will pay or get the economy price, which may be basically than web asset importance

The Of Investment Consultant

Typically, though, a monetary consultant will have some type of training. If it’s perhaps not through an academic system, it is from apprenticing at a monetary advisory firm (https://sketchfab.com/lighthousewm). Individuals at a strong that are nevertheless discovering the ropes in many cases are labeled as acquaintances or they’re a portion of the management staff members. As noted previous, though, a lot of advisors result from other fields

Some Known Details About Ia Wealth Management

This implies they have to place their customers’ desires before their own, among other things. Different monetary analysts tend to be members of FINRA. This does signify these include brokers whom additionally give financial investment guidance. In the place of a fiduciary requirement, they lawfully must follow a suitability criterion. Therefore discover a fair foundation for expense referral.Their own labels frequently state everything:Securities certificates, conversely, tend to be more concerning revenue side of trading. Financial analysts that are in addition agents or insurance representatives generally have securities certificates. Should they directly purchase or offer stocks, bonds, insurance rates items or offer financial information, they’ll need certain licenses connected with those products.

Some Ideas on Independent Financial Advisor copyright You Should Know

Always make sure to inquire of about monetary experts’ fee schedules. To track down this data independently, check out the firm’s Form ADV this files with all the SEC.Generally conversing, there have been two forms of pay structures: fee-only. ia wealth management and fee-based. A fee-only advisor’s main kind of compensation is by client-paid costs

When trying to realize simply how much a financial specialist costs, it's vital that you know there are various of payment methods they might make use of. Here’s an overview of everything might run into: economic analysts can get compensated a share of one's general possessions under administration (AUM) for dealing with finances.

All about Investment Consultant

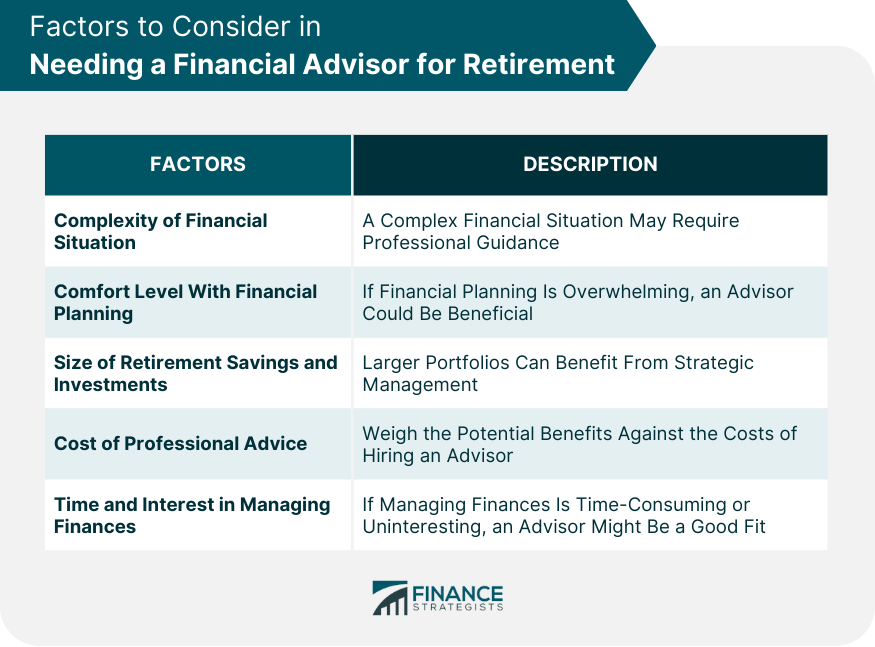

59per cent to at least one. 18%, normally. ia wealth management. Usually, 1per cent can be regarded as the standard for as much as a million bucks. A lot of advisors will decrease the percentage at larger degrees of assets, thus you’re investing, say, 1per cent when it comes down to investment representative first $one million, 0. 75% for the following $4 million and 0Whether you need a monetary consultant or perhaps not is determined by simply how much you have in possessions. You should also consider your own comfort and ease with money administration topics. When you have an inheritance or have recently enter into a sizable sum of cash, subsequently a monetary advisor could help answr fully your financial questions and manage your cash.

What Does Retirement Planning copyright Mean?

Those differences might appear evident to individuals in the investment industry, but many buyers aren’t alert to them. They might consider monetary planning as compatible with expense management and information. And it’s correct that the lines within vocations have grown blurrier previously couple of years. Investment analysts are more and more centered on supplying holistic monetary planning, as some people look at the investment-advice part to get basically a commodity consequently they are searching for broader expertise.

If you’re searching for holistic planning advice: an economic coordinator is suitable if you’re seeking wide financial-planning guidanceon your expense profile, but the rest of the strategy and. Look for those who call by themselves monetary coordinators and ask prospective coordinators if they’ve obtained the qualified monetary coordinator or chartered financial expert designation.

A Biased View of Investment Consultant

If you'd like financial investment information first and foremost: If you think your financial plan is within sound condition overall however you need help selecting and managing your own opportunities, a financial investment consultant may be the approach to take. Such folks are often subscribed investment analysts or are employed by a strong definitely; these advisors and consultative companies take place to a fiduciary standard.If you wish to delegate: This setup makes feeling for very hectic people that merely do not have the time or interest to participate within the planning/investment-management process. It is also something you should think about for earlier traders who are worried about the potential for intellectual fall and its influence on their capability to deal with their funds or investment portfolios.

What Does Financial Advisor Victoria Bc Mean?

The writer or authors you should never very own shares in almost any securities discussed in this specific article. Learn about Morningstar’s editorial guidelines.Exactly how close a person is to retirement, including, and/or influence of major existence events such as for instance relationship or having children. But these exact things aren’t according to the control of an economic planner. “Many occur arbitrarily and they aren’t some thing we could affect,” states , RBC Fellow of Finance at Smith class of company.

Report this wiki page